Venture Capital

Venture Capital and Private Equity

Venture Capital and Private Equity investments target rapid-growth companies. Such companies are typically start-ups, scale-ups and mature companies with a promising potential. By nature, venture capital provides high-risk investments and, therefore, it does not compete with low-risk financing (e.g., bank loans). Venture capital investors add value and actively contribute their expertise to foster business development and increase value of their target companies.

In Latvia, a relatively new market, venture capital funding is mainly provided by institutional investors, where substantial contribution stems from government agencies . As the capital market matures, the proportion of private funding in venture capital sector increases.

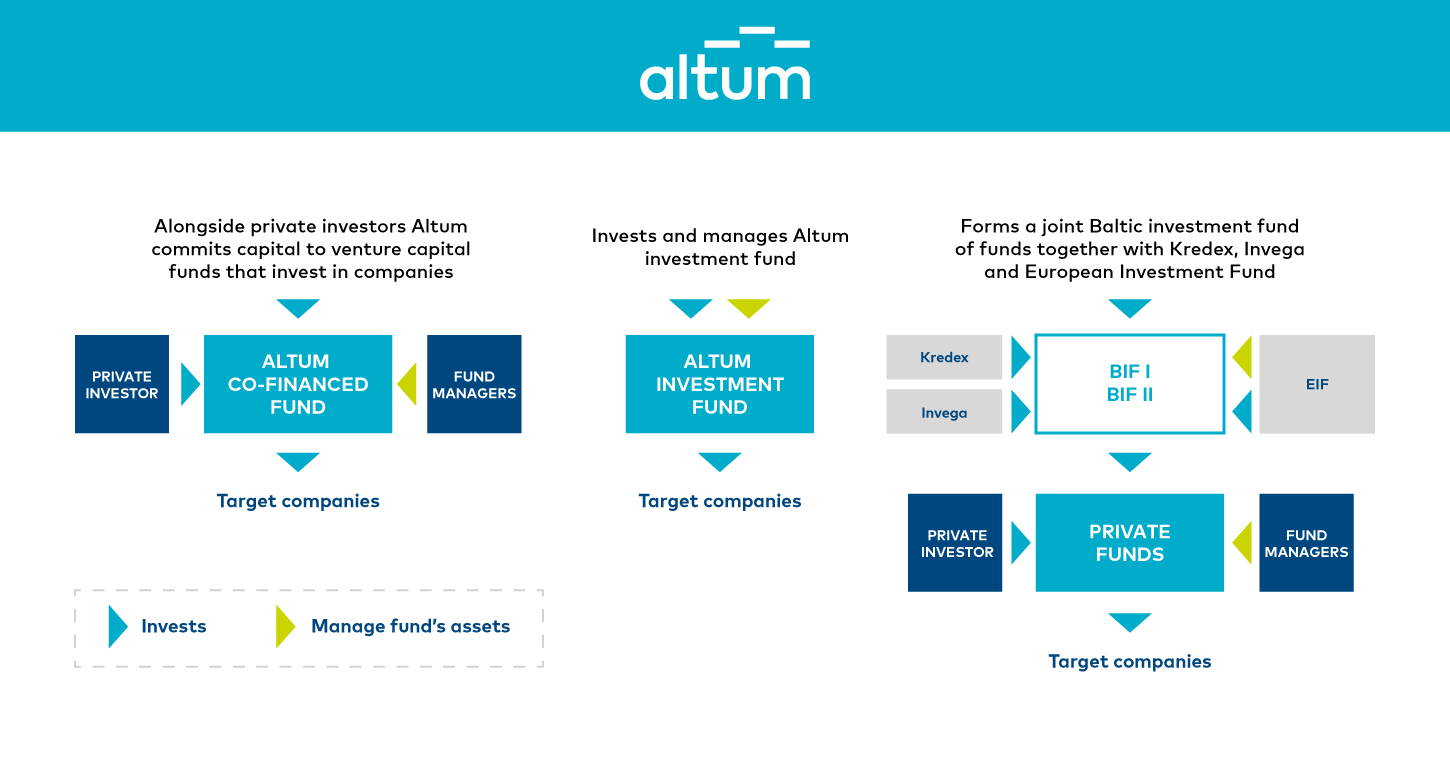

Altum venture capital investments

ALTUM plays a pivotal role in the creation of local venture capital ecosystem in Latvia. ALTUM invests substantial ERDF and state funds in the venture capital sector.

As of 31 December 2024, Altum has invested in 16 funds, including Baltic funds of funds (i.e., BIF1 and BIF2). Venture capital investments have contributed to the establishment of many start-ups with high added value products in IT, sciences and manufacturing industries.

101mEUR have been invested ensuring start-up growth and development*

335 companies have been supported through venture capital and private equity investments

Altum investments have contributed to over 184mEUR payments in taxes over the last 10 years

636 new jobs created, through funds of funds more than 10000 jobs secured

*Data on target companies, September, 2022

We are a member of Latvian Private Equity and Venture Capital Association (LVCA),

Invest Europe, European Venture Fund Investors Network (EVFIN), EIF-NPI Equity Platform, and European Women in Venture Capital.

Contacts for fund managers and policy makers:

Financial Intermediaries Department,

Email: rkf@altum.lv

News

26. May, 2025

ALTUM achieves its largest bond issuance to date

07. Jun, 2024

Selection of IPO Fund Manager Announced

04. Oct, 2021

ALTUM issues EUR 20 million bonds with a yield of 0.443%

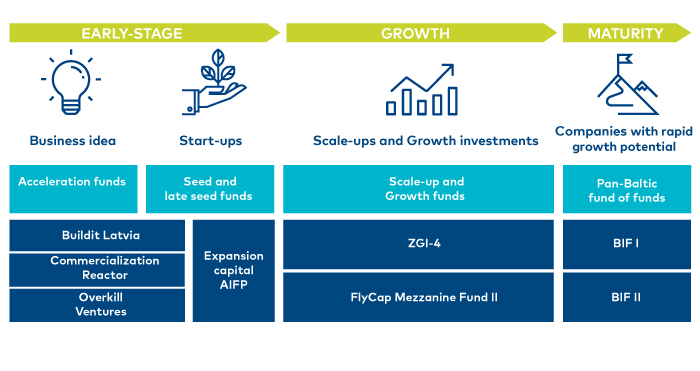

Types and uses of funding

Venture capital funding available to companies at different stages of development

Entrepreneurs striving to develop a scalable business idea, a ready-made project or those looking forward to amplifying an existing business are encouraged to use the most appropriate type of funding. Funds provide multiple financing opportunities to companies at different stages of development. In order to explore investment attraction opportunities please reach out to fund managers directly by using contacts provided in their websites.

What is venture capital intended for?

Venture capital could be:

investment in an enterprise with a high growth and a scalability potential

initial funding for early-stage companies to develop an idea or create a product

for growth stage companies to increase capacity or expand into new markets if traditional means of financing are not available

Altum-backed venture capital funds target high added value industries: IT, medicine, sciences, Green Deal.

How can a venture capital investment benefit your company?

The amount of venture capital funds available and the extent of an investor’s role in your company depends on whether it is only idea, a start-up or a company already conquering the market. Companies will receive not only funding, but also an active investor participation in business development and growth, knowledge about the chosen industry and networking benefits. These benefits will spur growth and value.

How to receive venture capital funding?

To find out more information about available financing and means of acquiring it, contact fund managers. To convince an investor of your idea’s, project’s or company’s future growth, you will need to provide a clear and an ambitious business plan with the capabilities to execute it. Key indicators: business plan viability, a team and its ability and competence to execute the plan as well as scalability of your business idea.

Make sure that your company is suitable for venture capital investments

Depending on specialization, choose venture capital fun

Contact fund managers

Fund managers

To find out more information about available financing and how to acquire it, contact fund managers.

Buildit Latvia

Maximum ticket size

Pre-seed stage: up to 250k EUR

Seed stage: up to 1,5m EUR

Find more information

BADideas.

fund

Maximum ticket size

Pre-seed stage: up to 250k EUR

Seed stage: up to 1,5m EUR

Find more information

Outlast Fund

Maximum ticket size

Pre-seed stage: up to 250k EUR

Seed stage: up to 1,5m EUR

Find more information

Latvian and Baltic entrepreneurs have access to substantial funding for scaling up their businesses in the European Union and globally, as well as to develop innovative products. Funding is provided by the Baltic Innovation Funds (BIF) under multilateral management agreement between the European Investment Fund (EIF) and Baltic financial development institutions: Altum (Latvia), ILTE (Lithuania) and EIS (Estonia).

Currently, two fund of funds programs are operating: BIF 1 and BIF 2. It is planned that the BIF3 fund program will be launched in 2025.

For fundraising opportunities, we kindly suggest to contact fund managers working with BIF 1 and BIF 2 funding by using the contacts listed on their websites.